Robust performance driven by quality and breadth of global capability and continued investment in strategic priorities

Financial results for the year ended 30 April 2021 (FY21)

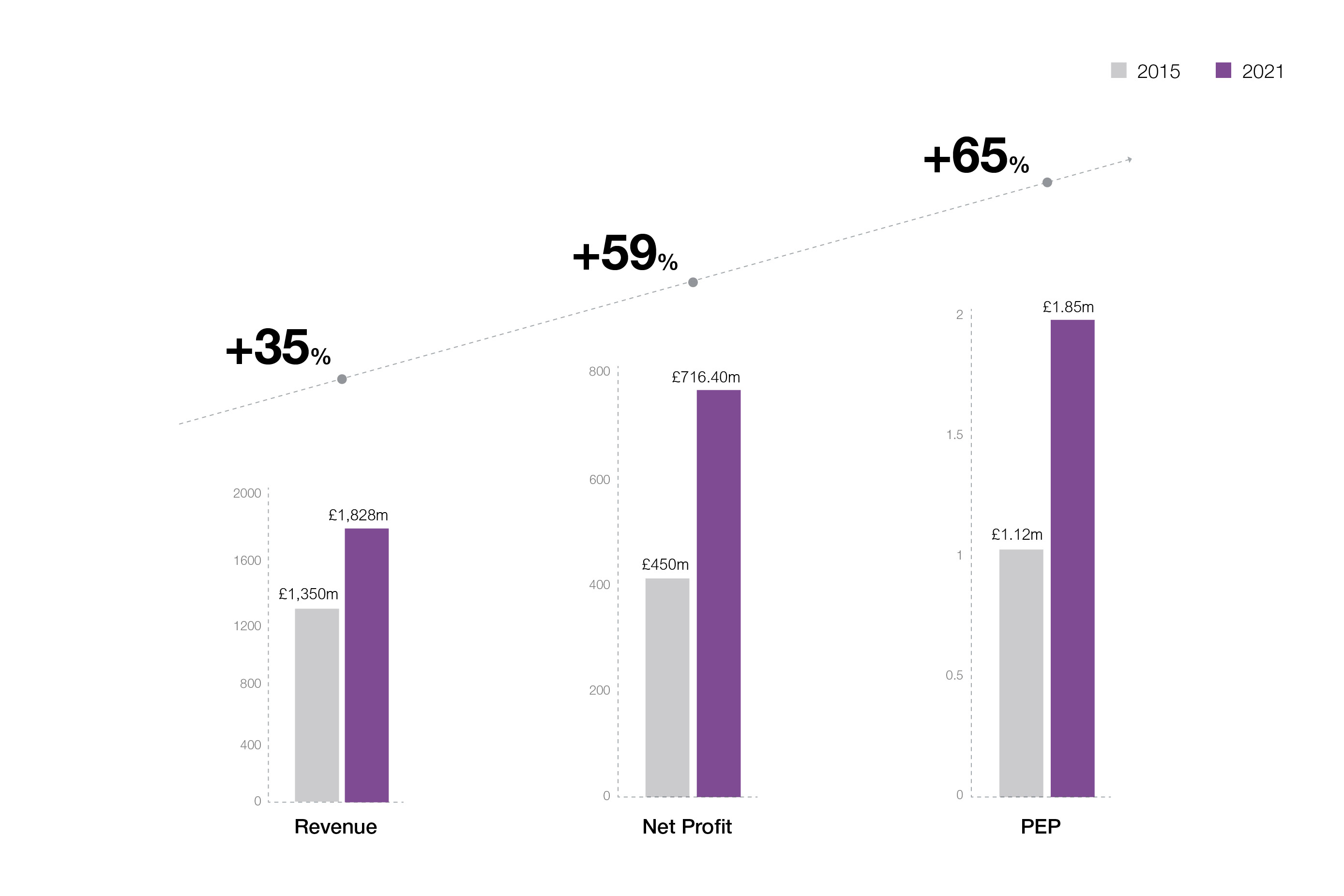

- The firm recorded its sixth consecutive year of profit and revenue growth, and its strongest performance to date

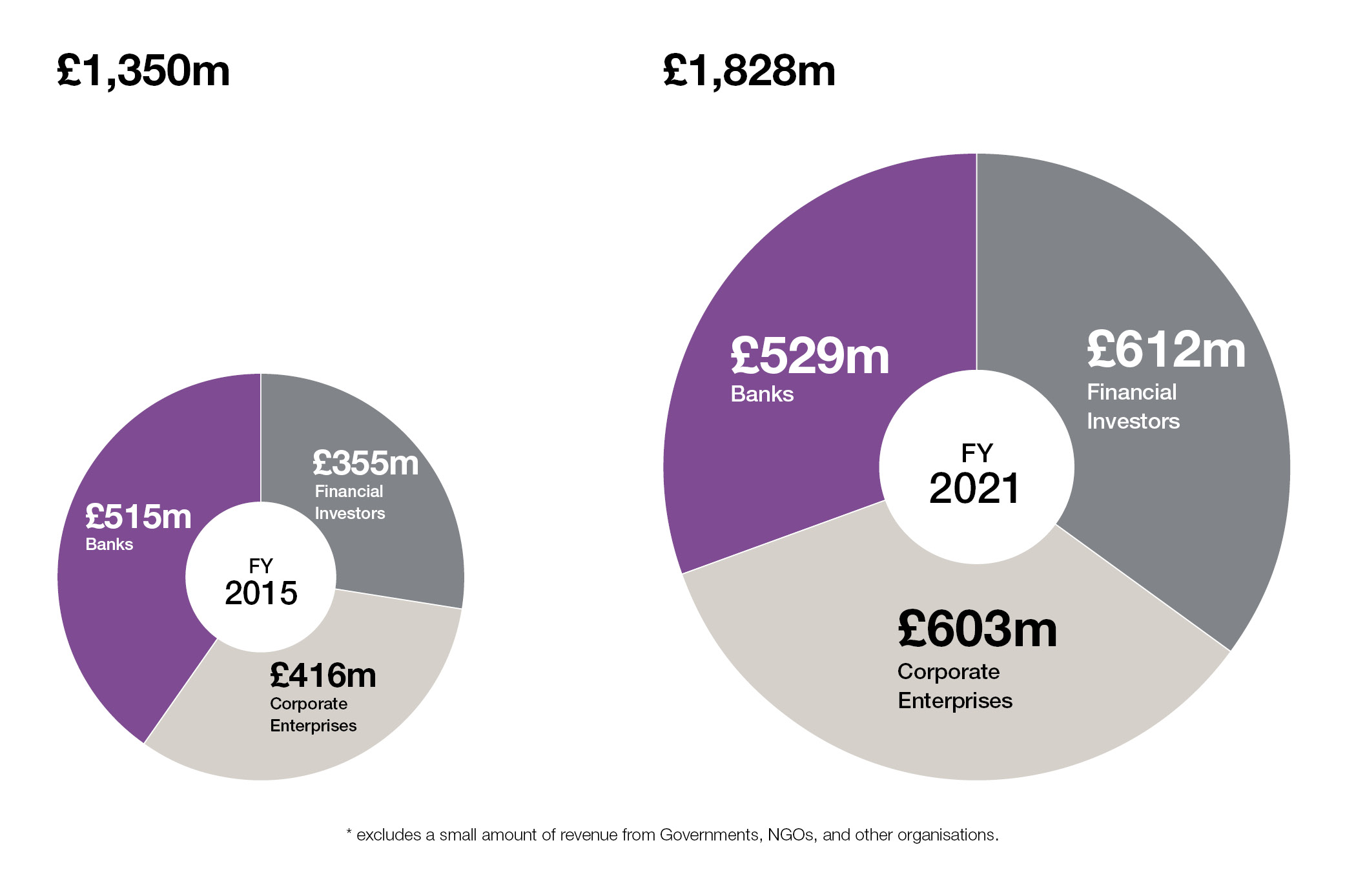

- Revenues of GBP 1,828 million, representing growth of 1% year on year

- Partnership profit GBP 716 million, an increase of 8% year on year

- Profit per equity partner GBP 1.85 million, an increase of 9% year on year

- In US Dollars, these figures are equivalent to revenues of USD 2,413 million, profit USD 946 million, profit per equity partner USD 2.44 million

- In Euros, these figures are equivalent to revenues of EUR 2,047 million, profit EUR 802 million, profit per equity partner EUR 2.07 million

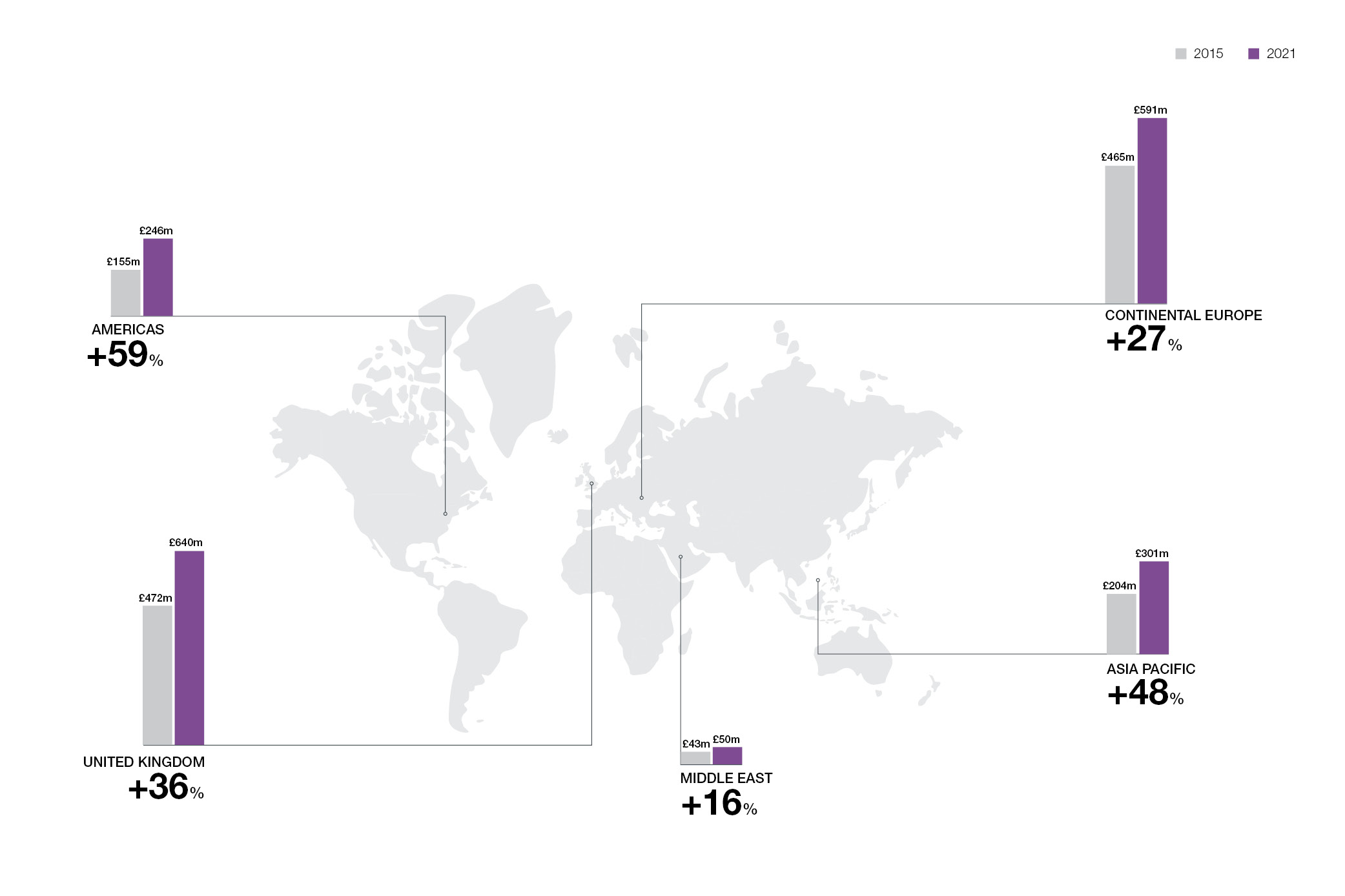

The year saw demand increase each quarter, from a challenging first few months significantly affected by Covid-related uncertainty through to a final quarter which saw activity at all-time record levels in many practices and geographies. As a result, the global revenue and profit performance for the year were Clifford Chance's strongest to date, with the momentum from a record final quarter continuing into the new financial year.

The FY21 results represent Clifford Chance's sixth consecutive year of growth, since the introduction of the firm's strategy in FY15. During this time:

- Revenues have increased by 35%

- Partnership profit has increased by 59%

- Profit per equity partner has increased by 65%

The combination of robust revenues, prudent cost management and increased emphasis on financial and commercial discipline, resulted in the firm ending FY21 with GBP 370 million in cash and no net borrowings.

FY15-FY21 strategic progress - read our key financial indicators below

Matthew Layton, Clifford Chance Global Managing Partner comments:

"I am hugely proud of what our team has achieved this year. Our goal is always to stand shoulder to shoulder with our clients giving them the very best advice and support on their most complex and business-critical matters; and never has this been more important. Our robust financial performance reflects the value that clients place on that partnership and on the expertise and dedication of our teams.

"Despite many challenges, this has been a year of progress: we have maintained our momentum in advancing our strategic priorities and in investing for the firm's longer-term future in line with our vision. We have also begun important work to map out how we will operate in the new world as communities and economies start to emerge from the shadow of the pandemic.

The strength of our platform

"The breadth of our practice across areas of expertise is a huge asset. It enabled us to work seamlessly to support clients as their needs shifted over the course of the year, as businesses shored up their balance sheets, took steps to restructure and then – in some cases – have raced back into the market to position themselves for future success. As a result, our highly regarded, global transactional practices, first in refinancing, restructuring, insolvency and then in corporate advisory, M&A, as well as our antitrust teams, have experienced significant peaks in activity levels.

"The other major theme of the year was the accelerated digitalisation of all aspects of our lives and business. Tech is one of our strategic priorities and we have been investing in our capability there for some time, including the addition of a further 10 new partners over the past year alone. Our teams have been in great demand with revenues jumping over 16% year on year as clients have sought informed advice that combines deep digital, data, IP and cyber knowledge with sector insight and broad-based legal and regulatory capability.

"We are also proud of the impact our work has had in response to the pandemic, from advising Pfizer on its partnership with BioNTech to helping governments procure vaccines. This is in addition to our work with a large number of non-profits, from helping criminal justice watchdog Fair Trials to track the impact of Covid-19 on access to justice to preventing the eviction of Sistah Space from their domestic violence support centre, just as that problem escalated sharply."

Investing in our client priorities

"We know there is no room for complacency and we must constantly invest ahead of and in tandem with evolving client demands.

"Ensuring we consistently deliver the very best support to our Financial Investor clients and helping businesses to navigate ESG issues and invest sustainably for the long-term are both fundamental to our ambitious strategic vision for the firm. As with our Tech Group, we already have fantastic track-record and deep expertise in these areas and are investing in a targeted way in capabilities that will keep us at the forefront of the market globally.

"As well as setting the standard for the very best quality legal advice available to clients, we are committed to ensuring our service and delivery experience meets the evolving needs of our clients in a fast-moving market. We therefore continue to push forward our broad-based Innovation agenda, including the launch this year of our new Research and Development Hub.

Laying foundations for our future success

"The past year has intensified our focus on securing strong foundations for our future success; understanding what clients will need from us and what type of firm we will need to be. The fundamental building blocks for that must be a high performing, collaborative, and inclusive culture and a best-in-class operating platform.

"We have never been in doubt that we are a people business. We are shaping all aspects of the firm so that we recruit, develop, motivate, and retain the very best talent in an environment where everyone is valued and thrives. In addition to our vital work around inclusion, our wellbeing support for colleagues has been especially front of mind during the past year and will be a focus for us as we move forward. I expect our people agenda to be at the very heart of the firm's strategic priorities over the next few years as we embrace digitally enabled, hybrid working globally and ensure that the totality of the experience we offer our people - the career and development opportunities, the support infrastructure, their reward and ability to be part of an inclusive, high performing culture - is unmatched in the market.

"As we look ahead, agility and a readiness to embrace change will be critical. The past year has shown us how quickly and effectively we can introduce change when needed. The successful global roll-out in FY21 of our biggest IT transformation project ever, underlined the scale and impact of what we can achieve and reflects a wider change that has taken place across the firm as we have embraced the potential of digital technologies. We will seek to further leverage the benefits of consistency, efficiency and data-driven improvements in the years to come as we continue to invest in the forward-looking, high quality operating platform that is a crucial enabler of our future success."

Looking ahead

"We ended FY21 with high levels of transactional and advisory activity and we expect that considerable momentum to continue this year. As courts and regulators start to resume more normal operations, and as businesses consider the wider impacts of Covid, we also expect to see increasing demand from clients for litigation and other dispute resolution support. Our strong offer here – an area where we have been further investing over the past six years – and our strength across client sectors and geographies means we are well placed to provide the full complement of advice that clients will need as they enter this next phase.

"While confidence is running high in some markets as they look forward to a robust bounce back from the impacts of the pandemic, there remain points of significant uncertainty and many communities globally are still suffering immensely. Amongst our clients, our NGO partners and our networks across government and multilateral organisations, we see that there is a shared commitment to build back better as we emerge from Covid. We believe that our expertise, the depth of our talent and our ability to bring together different organisations in impactful partnerships mean we have an important role to play in creating a more sustainable recovery.

"Regardless of how the year unfolds, the key to our future success will be our people and our clients. I would like to thank our clients for the trust that they have continued to place in us. In return, we know we must continue to challenge ourselves so that there is no other firm better placed to provide them with the excellence of advice and client service that they will find at Clifford Chance. And – most importantly – I would like to thank our people for their extraordinary efforts, energy and commitment often while facing the most difficult of personal circumstances. The success of the past year is a testament to the quality our teams of globally, and the culture of mutual support that has underpinned all they do."

Selected strategic and investment highlights from the past year

- Appointed Kai Schneider to drive the firm's Financial Investors strategy, a role with a seat for the first time on the firm's top strategic decision-making body, the Executive Leadership Group. Kai will ensure that the interests of these clients sit at the heart of Clifford Chance's strategic thinking

- Established a new ESG Board, led by Global Senior Partner Jeroen Ouwehand. The ESG Board works with a team of over 400 lawyers and senior business personnel with deep experience in issues of ESG and sustainability to ensure clients have access to joined-up advice around emerging and best practice in a broad range of areas from energy transition to preventing human rights abuses and sustainability-linked finance

- Invested in 36 new partners globally, through internal promotions and high-profile lateral hires in areas such as litigation, international trade, tech and funds

- Launched a new Research and Development Hub that will accelerate the scale and development of digital products and solutions – both for sale to our clients through Clifford Chance Applied Solutions, and to help transform the firm's own operations

- Refreshed the firm's global leadership team, including the appointment of Connie Heng as Asia Pacific Regional Managing Partner, Chinwe Odimba-Chapman as Global Partner for Talent, Grant Eldred as Chief People Officer and Robin Abraham as General Counsel. All four attend the Executive Leadership Group

- Made progress against our global inclusion goals, including setting granular targets across regions and business units, undertaking an independent inclusion review of the partnership process, establishing new guidelines to support diversity in recruitment, and expanding the reach of and engagement with the firm's reverse mentoring and affinity networks

- Enhanced our wellbeing and wider support to colleagues informed by regular surveys of our teams globally. Additional support offered has included targeted, practical training to help build resilience and a range of psychological support, including access to two clinical psychologists. Reflecting the importance of wellbeing and mental health, the firm was a founding supporter for the Global Business Collaboration for Better Workplace Mental Health

- Shifted from a physical to virtual global implementation of iManage, a completely new document management system – a core technology that is fundamental to the firm's way of working. This saw the migration of approximately 52 million documents, with up to two and a half hours of training each for over 6,000 users. All delivered over the course of 12 months. Every aspect of the roll-out was managed remotely

Selected client highlights from the past year

- Advising Pfizer on its agreement to co-develop a Covid vaccine with BioNTech. The first to be approved by the US, EU, and UK, the vaccine was the result of a partnership put in place in record time by a team led by Clifford Chance's global intellectual property group

- Acting for Epic Games in litigation against Apple and Google in the UK and Australia relating to Fortnite, one of the most popular computer games in the world, and in relation to complaints to the European Commission and the UK Competition and Markets Authority in the context of their ongoing investigations into Apple's AppStore

- Advising on a series of stand-out Tech IPOs, including:

- the Hut Group on its GBP 1.88bn IPO, the largest in London since 2015 at the time of listing;

- private-equity-owned Polish e-commerce company Allegro on its PLN 10.6bn (USD 2.7bn) IPO, the largest ever IPO on the Warsaw Stock Exchange, and second largest capital raise in Europe at the time of launch;

- the banks on Kuaishou's USD 5.4bn, Hong Kong's largest technology IPO in history and the world's largest by a technology company since Uber in 2019; and

- the banks on InPost's EUR 3.2bn offering and Euronext Amsterdam listing - Europe's largest ever tech IPO, CEE's largest ever IPO, and the largest IPO in Europe in the last decade

- Advising the banking syndicate on the Republic of Italy’s inaugural EUR 8.5bn green bond issue, Europe’s largest-ever sovereign green bond debut

- Advising Anheuser-Busch InBev on its inaugural USD 10.1bn sustainability linked financing

- Advising Citi on the International Bank of Reconstruction and Development's (IBRD or World Bank) USD 100m bond used to support sustainable development activities and UNICEF's pandemic response programs for children around the world

- Advising the Argentina Creditor Committee on the historic sovereign debt restructuring of approximately USD 65bn of eligible bonds by the Republic of Argentina, a critical step towards the recovery of Argentina's economy in the midst of the COVID-19 pandemic

- Advising "Decarbonization Plus Acquisition Corporation II" on Australia's first SPAC merger, a USD 1.2bn merger with electric vehicle (EV) fast charger developer Tritium, set to go public on the NASDAQ

- Advising PIF on the USD 69.1bn sale of PIF’s shareholding in SABIC to Saudi Aramco and the SABIC team separately on the global antitrust aspects of the transaction through a separate team behind confidentiality barriers– the largest ever M&A deal in the Middle East

- Advising San Francisco-headquartered Sitecore on its acquisition of Dublin-based SaaS business Boxever. Part of Sitecore's USD 1.2bn investment plan to drive growth and product innovation

- Advising leading Canadian insurer Intact Financial Corporation on its GBP 7.2bn takeover of RSA Insurance Group and the associated separation of RSA's Scandinavian business – a particularly complex transaction and the largest public takeover in the London market in 2020

- Advising European energy company Vattenfall on its EUR 1.6bn sale of 49.5% of offshore wind farm Hollandse Kust Zuid (HKZ). HKZ will become the world's largest wind farm, and the first to be built without subsidies for the power produced

- Advising on an integrated value chain to deliver green hydrogen across Europe at a price competitive with fossil fuels, and also advising the Green Hydrogen Coalition on the formation and operation of an integrated value chain to deliver affordable green hydrogen into the Los Angeles basin

- Representing Avima Iron Ore Limited in its USD 27bn dispute with the Republic of Congo, which called for damages or the restoration of its mining license

- Advising investment firm Lucerne Capital Management on a court dispute over Next Private BV's EUR 5.7bn takeover offer for telecoms company Altice Europe, which ultimately resulted in a 30% increase in the offer price as part of a settlement

- Advising Haier Smart Home on the privatisation of its Hong Kong subsidiary Haier Electronics Group, involving a bond restructuring and Hong Kong listing

- Advising global investment manager VanEck on historic Ethereum ETF registration statement with a view to creating the first US-listed exchange traded fund (ETF) for the cryptocurrency Ethereum

- Advising Permira-backed alterDomus on its strategic acquisition of technology provider Investors Economic Assurance, having previously advised on a number of other acquisitions

- Advising Fortune 500 power company AES Corporation's Panamanian subsidiaries on the largest transaction by a private company in Central America, the refinancing of an aggregate USD 1.5bn in existing debt.

Clifford Chance

Clifford Chance